COVID-19 is Changing the Food Industry

In a paper published in mid-March 2020, data and insights leader Nielsen discussed a study identifying six key consumer behavior shifts happening because of the COVID-19 outbreak. These “behavior thresholds”, as Nielsen calls them, signal changes in consumer spending. The six behaviors evolve from consumers’ state of early preparedness to the new normal state of living post-COVID-19.

These behavior shifts are having a major impact on the food industry and will likely lead to permanent changes in how consumers shop for food and how supply chains respond to changing consumer demand.

#1 Proactive Health-Minded Buying |

#2 Reactive Health Management |

#3 Pantry Preparation |

#4 Quarantined Living Preparation |

#5 Restricted Living |

#6 Living A New Normal |

|---|---|---|---|---|---|

| Consumer Behavior Shifts | |||||

| Interest rises in products that support overall maintenance of health and wellness. | Prioritize products essential to virus containment, health and public safety. E.g. face masks | Pantry stockpiling of shelf-stable foods and a broader assortment of health-safety products; spike in store visits; growing basket sizes. | Increased online shopping, a decline in store visits, rising out-of-stocks, strains on the chain. | Severely restricted shopping trips, online fulfillment is limited, price concerns rise as limited stock availability impacts pricing in some cases. | People return to daily routines (work, school, etc.) but operate with a renewed cautiousness about health. Permanent shifts in supply chain, the use of e-commerce and hygiene practices. |

| COVID-19 EVENT MARKERS | |||||

| Minimal localized cases of COVID-19 generally linked to an arrival from another infected country. | First local transmission with no link to other location + first COVID-19 related death/s. | Multiple cases of local transmission and multiple deaths linked to COVID-19. | Localized COVID-19 emergency actions. Percentage of people diagnosed continues to increase. | Mass cases of COVID-19. Communities ordered into lockdown. | COVID-19 quarantines lift beyond region/country’s most-affected hotspots and life starts to return to normal. |

| Source: The Nielsen Company | |||||

Early behavior shifts are already apparent in most parts of the world. In fact, most regions are already in behavior threshold #3 or beyond. Some examples include:

- The United States is already at “restricted living”, as evidenced by widespread “out of stocks” at food stores.

- Most of Europe is also in a state of “restricted living”, with “Hamsterkäufe”, or stockpiling of food essentials evident across the continent. Restricted travel is the norm, especially in Italy, Spain, and Belgium, but also other EU countries.

- Russia remains at the “reactive health management” threshold, but the fall in oil prices due to the standoff with Saudi Arabia is hitting consumers nonetheless.

- In South America, conditions vary from “reactive health management” in Brazil to “restricted living” in Peru where the situation is quite serious.

- In China meanwhile, they are moving from “restricted living” into the “living a new normal” threshold, with work resuming in every province except Hubei. The long-term impact on consumer behavior is still an open question.

Economic Considerations

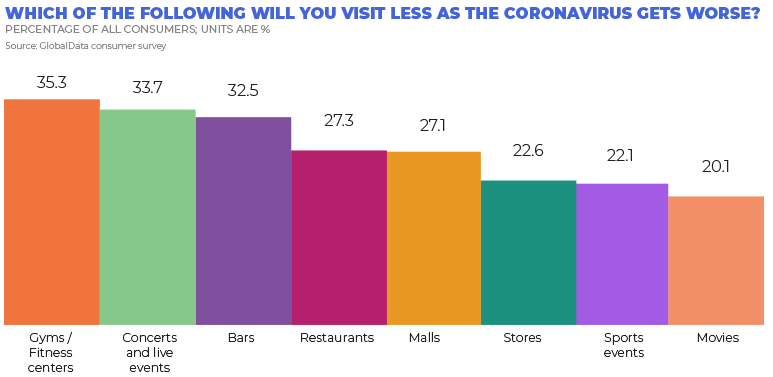

Global Data reports that many economists are now predicting the onset of recessionary conditions with some markets down 25-50% so far this year. The hardest hit markets are restaurants, bars, live events, entertainment, and other sectors of the economy. Fortunately, for those in the packaged food industry, the outlook is brighter. However, the brighter outlook comes with new challenges.

How should manufacturers forecast budgets and production in the months to come? Even if consumers feel they have their pantries stocked, the industry will need to build up inventory reserves. Manufacturers may also want to increase safety stock levels on raw materials if the demand spike does not recede as much as expected. At their quarterly conference call, General Mills CEO Jeff Harmening made the comment that “The change in consumer behavior are the likes of which we have never seen.” He went on to say, however, that what was true last week is not this week.

A Stable Foundation in the Global Food Supply Chain

As both retailers and manufacturers prioritize the re-stocking of essential food items in response to COVID-19, the daily routines and activities of food scientists, purchasing managers and operations personnel have changed. The focus shifts from product innovation and new launches to minimizing supply disruptions and shortages.

As one of Sensient’s Technical Managers said to me the other day, “Even when it seems like the world is coming to a screeching halt, people and our pets still need to be able to eat.” That is exactly the mindset at Sensient right now. Our commitment is to do everything we can to keep operations running so that customers can meet their obligation to consumers.

At Sensient, our sole focus right now is to provide service to customers so that they can get food to everyone around the world. Specifically, I would like to share some of our key priorities:

- Providing a safe work environment for our employees so they can do their work

- Proactive and ongoing communication with our customers as conditions change

- Utilizing our global manufacturing capabilities to avoid supply disruptions

- Increasing inventories on raw materials wherever possible to enable ongoing production

In the short-term, fluctuating demand conditions are likely to create unique challenges, but Sensient Colors is committed to doing everything we can to supply needed ingredients to food, beverage, and pet food manufacturers. We are also preparing for what the world might look like post-coronavirus.

As Sensient CEO Paul Manning said in a note to all of our employees – “We have to do our jobs and make our products, because no matter what else happens, people need to eat and take medications.”

We will remain open for business.