Converting Food and Beverages to Natural Colours

A Queue is Forming:

Are You In It?

As a global colour company, Sensient has a unique responsibility to monitor and observe shifts in the use of colour by the food and beverage industry. Today, consumer demand for natural ingredients and clean labels continues to rise across all regions of the globe.

Natural Colour Use in Food & Beverage

vs. General Colour Use

Globally, 4 in 5 Coloured Products

Launched or Renovated in 2023 and 2024

Use Natural Colours.

MINTEL 2024

While this use of natural colours in new product launches has been pretty consistent over the last several years, many of the most well-known legacy products continue to make use of synthetic colours. This makes sense, as their loyal consumers are very happy with current formulations.

However, recently both NGO’s and some regulatory bodies are attempting to expedite the transition to natural colours.

2022

EU Bans Titanium Dioxide

from Food, Beverages,

Pet Products

2023

California Bans Red 3,

Effective 2027

2024

Several US States Introduce Proposed

Legislation That Attempts to Ban One

Or More Synthetic Colours.

While bans from individual States in the U.S. theoretically apply

only to the local jurisdiction, the reality is that food retailing is an industry

with national retailers and distribution networks.

In a practical sense, it is impossible for brands and retailers to ensure that products destined for one State would not end up on the shelf of a State where a ban is in place. Hence, the State initiatives end up being de facto national bans.

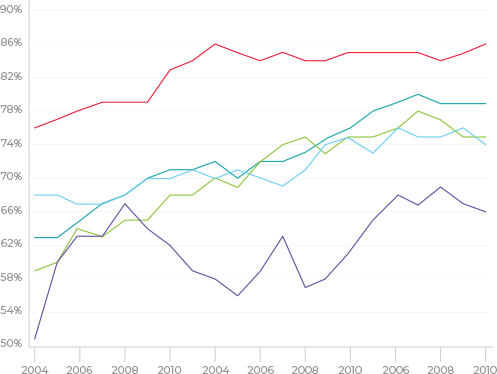

A similar challenge is faced by brands in regions like Europe, where natural colours are already the norm. The first massive conversion wave from synthetic to natural colour usage formed in 2008: the European Commission published specific labelling requirements for six synthetic azo dye colours that almost eliminated their usage in food and beverage products.

Currently, the next phase of conversion is from natural colour additives with “e numbers” to “colouring foods” that have more consumer accepted labeling requirements.

Regardless of the reason manufacturers undertake the difficult conversion process,

Four Key Factors Need To Be Considered:

KEY FACTOR

USAGE RATE IMPACTS

Work with a colour expert to find the best replacement(s) for your

current colour lineup and formulate with usage rate changes in mind.

Because colours from natural sources are less highly concentrated than synthetic colours, brands should expect to see a volume increase in the colour needed to achieve the same shades. Manufacturers can expect a volume increase of 4 to 12 times more material compared to synthetic colour volumes when switching to natural solutions.

The increase is dependent on both the shade target and the application or product. More highly concentrated natural colours or colouring foods can help to mitigate the increased usage rate, but higher strength colours will still use more botanical material unless the increased strength is achieved by developing higher pigment material.

KEY FACTOR

PREPARING YOUR FACILITY

Consider investments in refrigeration and storage capacity

to handle increased inventory.

While synthetic colours have minimal storage requirements, many natural colours and colouring foods require refrigeration and have a shorter shelf life than their synthetic counterparts. Manufacturers will need to prepare for expanded colour product storage and potential refrigeration. The other alternative is to use natural powders, but these generally cost more than liquids.

KEY FACTOR

SECURING THE SUPPLY CHAIN

Ask your colour supplier about their supply chain security and

ability to scale up volume as needed.

Unlike synthetic colours, developing a robust and redundant supply chain security for colours from natural sources is both critical and complex. Since colours from natural botanicals are typically derived from orphan crops, increasing supply to meet growing demand needs to be carefully planned. It is also true that some key botanicals are often grown in only one or two countries. Sensient has invested in vertical integration across many of the most important colour botanicals and can scale volume more easily, while also ensuring multi-hemisphere redundancy to reduce climate related risks. However, the scale up process typically will take several years to accomplish. The steps required include seed production, multi-hemisphere planting, primary extraction expansion, and processing expansion (if necessary).

KEY FACTOR

PREPARING A COLOUR PARTNERSHIP

Rather than selecting a preferred formula first and then

addressing supply chain, consider addressing technical and

supply chain questions concurrently. Develop a timeline that

meets your needs with your colour partner.

Agronomy and agriculture take time to expand: Even the most prepared colour manufacturer may need up to three years to produce large quantities of botanically sourced colours based on growing cycles. Additionally, if every brand on the market is forced to make a swap at the same time, there will be a bottleneck in the supply chain as demand outpaces supply. Forecasting colour needs and securing contracts with your colour supplier can ensure availability for your products on the timeline you need.

At Sensient, we are ready to help you make this transition smoothly.

We anticipate the coming market shift and are readying our supply chain, our manufacturing facilities, and our teams to handle the influx of natural colour and colouring foods needs.

We encourage our customers and all food and beverage brands to ask your colour supplier(s) about their preparation for a colour conversion project and the potential for a major market shift forced by consumer demand or regulatory requirements.

Are you ready to convert? Learn more by connecting with our team.