Pet Products Post-COVID

Continuing Opportunities in the Pet Category

Increasingly, most pet owners have a parental mindset when it comes to their furry companions. What this means when it comes to pet food is increasing ingredient scrutiny. Pet parents are looking for optimal nutrition without the synthetic ingredients they avoid personally. This creates opportunities for brands that respond to the evolving pet parent demands and develop products that meet their requirements.

Increasingly, most pet owners have a parental mindset when it comes to their furry companions. What this means when it comes to pet food is increasing ingredient scrutiny. Pet parents are looking for optimal nutrition without the synthetic ingredients they avoid personally. This creates opportunities for brands that respond to the evolving pet parent demands and develop products that meet their requirements.

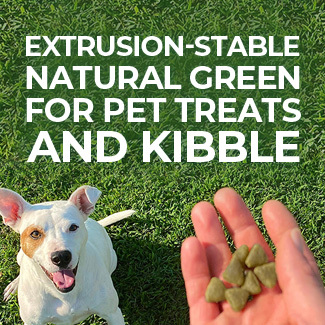

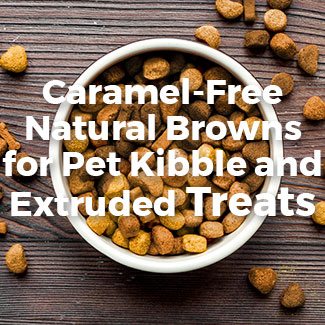

Brands can cater to unique dietary needs with customization. As we have previously discussed, color can be used to highlight key nutritional components in kibble to offer pet owners a visual cue.

Further reflecting the health-focused “naturalness” movement, natural ingredients are one key to success, especially with younger pet owners. Claims of “natural” and “organic” have been rising among new pet product introduction for several years and continue to gain interest.

Since pets are now considered full-fledged family members, treats are growing in popularity. They enable pet parents to connect and bond with their pet in a mutually delightful way. The humanized pet trend is on display when it comes to special treats. Pet-friendly ice cream, crunchy snacks, and even drinks are emerging to enable owners to share experiences directly with their pet.

The Impact of COVID-19

The Impact of COVID-19

The bond between pets and their owners grew even closer due to the global pandemic. As people around the world turn a closer eye on their own health, it should come as no surprise that 38% of pet owners are also paying more attention to the health of their pets since the news of COVID-19 was announced (Mintel 2020).

63% of pet owners reported spending more time with pets during the global lockdown.

(Mintel 2020)

This unique period of “forced nesting” during which people spent more time with their families and therefore their pets, led to extra attention and often extra care. Even as a recession loomed, 17% of pet parents said they spent more on pet supplies. This is likely to lead to increasing interesting in treats and kibble with additional functional health benefits.

Consumers continue to project our values and needs onto our pets. As humans look positively on ingredients with “better-for-you” positioning, functional benefits, and immunity advantage associations in a post-COVID world, they will also be drawn to pet food with a “health halo”.

Keeping People and Pets Healthy

We expect to see growing interest in functional benefits in the pet space as the Immunity Advantage scenario takes hold. “Natural” will be expected, and functional is the next step up—just one or the other will not be enough for the more concerned pet owner.

Color is currently used by several leading brands to highlight nutritional benefits in pet products. Blue Buffalo, for example, touts their exclusive LifeSource Bits® as special kibble pieces mixed into each package that deliver key vitamins, minerals, and other nutritional supplements for dogs and cats. Consumers can differentiate these smaller, darker, nutrient-dense pieces both on the packaging and in each bowl they serve their pet.

Made Where?

The pandemic has also highlighted potential gaps in the global supply chain for some brands and is pushing some consumers towards more regional and local products. These consumers want to support brands that include more local ingredients in formulas.

The pandemic has also highlighted potential gaps in the global supply chain for some brands and is pushing some consumers towards more regional and local products. These consumers want to support brands that include more local ingredients in formulas.

While earlier waves of the localism trend were driven by fear of certain ingredients produced in China, 2020 has seen a major shift. Many consumers are looking to support local and national communities because of the economic hardship that the pandemic has caused. In the North American pet space, we expect to see this further accelerate the push towards “made in America” or “made in Canada” labeling. Innovation in the pet space with regionalized claims can appeal to these customers.

The Pet Category Post-COVID

These scenarios are seen across many industries and countries, and the effects on each category are different. Sensient’s global, cross-market perspective gives us a bird’s-eye-view of the landscape and what’s coming next.

Although pet products didn’t see a dramatic spike in sales of the same magnitude that other categories did during the lockdown, the pandemic may have more lasting impacts. In this video, I discuss the pet category and the trends accelerated by the COVID-19 crisis:

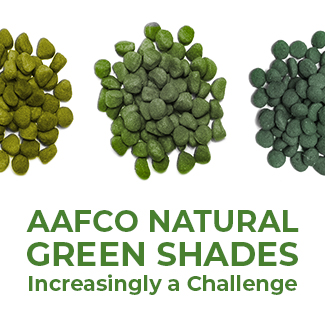

Our webinars include a recent introduction to natural colors that are stable and AAFCO-approved in extruded pet applications like kibble and treats. You can register for more upcoming live webinars here or view our on-demand sessions for industry insights and technical education at any time here.

Get started on your next big thing with a natural color sample. If you need more information, advice, or product-specific insights, request a consultation with a member of our team!