Market Trends in the Growing Plant-Based Meat Category

There’s no denying that consumer demand for plant-based meat analogues is shifting the market. From major brands looking to capitalize on the segment’s growing popularity, to new up-and-coming brands innovating quickly, everyone wants a piece of the plant-based meat pie. So what opportunities are there for a brand to make room for itself on the increasingly crowded shelf?

Opportunity: Target Growing Flexitarian Market

While consumers identifying themselves as “vegan” remain a relatively small portion of the population, a significantly larger percentage are increasingly trying to reduce their consumption of meat overall. Motivations range from health-oriented to environmental concerns, but the result is that an opportunity exists for brands to produce plant-based meat products that don’t need to cater to the restrictive vegan label. Products that combine animal and plant ingredients into “blended” meat alternatives are an easy way for brands to dip a toe in the plant-based waters. Brands that choose this route can connect with consumers that have both flexitarian and more mainstream “omnivore” diets. Blended products can align with both protein-heavy and ethically-aware dietary patterns, capitalizing on the idea that even a little traditional meat, poultry, or fish can make a big difference in taste.

Products that combine animal and plant ingredients into “blended” meat alternatives are an easy way for brands to dip a toe in the plant-based waters. Brands that choose this route can connect with consumers that have both flexitarian and more mainstream “omnivore” diets. Blended products can align with both protein-heavy and ethically-aware dietary patterns, capitalizing on the idea that even a little traditional meat, poultry, or fish can make a big difference in taste.

Plant Based Meats market in the Asia-Pacific

region was worth $15.3 billion in 2019, up 4.75% from 2018.

(Euromonitor 2020)

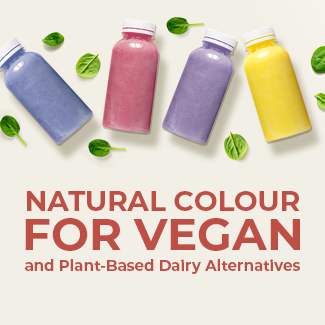

A 2020 study by the Plant Based Foods Association (PBFA) and Kroger found that plant-based meat sales were up 32% when placed in the meat department. In products targeting flexitarian consumers, color can be critical in ensuring that the final visual matches the expected visual of the traditional product. The raw color needs to transition completely to the cooked appearance, and color experts can help identify the natural color solutions to create the visuals consumers expect. In order to resonate with consumers, the next wave of meat substitute innovations will need to deliver a full sensory experience, from taste and texture to the raw and final cooked appearance.

Opportunity: Deliver Unique Formats and Products

Advanced developers are looking to create differentiation for their brands by releasing products that fill more niche markets. According to Mintel, a Dutch company has developed the world’s first vegan ribs, and alternative snacks like kelp jerky, veggie cocktail sausages, and even meat-free carpaccio are on the rise. As the frozen and chilled aisle becomes more and more crowded, brands need to continue to innovate beyond burger patties and sausages. Color can be a key differentiator and help stand out on a shelf or in a cooler. Convincing and appealing visuals, whether an imitation of raw meat or pre-cooked packaged products, can be achieved with a variety of cost-effective blends with botanical labeling, as our technical team has previously discussed.66.8% ALL MEAT-SUBSTITUTE LAUNCHES

introduced in Asia Pacific were unflavored in 2019

(Mintel 2019)

Opportunity: Create Nutritional Value

Beat traditional meat products by developing recipes with higher protein and a lower sodium profile.71% of Chinese Consumers

have incorporated plant-based foods to balance their daily diet

(Mintel 2019)

Opportunity: Spotlight Sustainability

Plant-based meat is often positioned as good for both the environment and for animal welfare. Connecting these products to sustainability and corporate responsibility efforts can engage consumers motivated by environmental concerns. A 2018 study by Beyond Meat, the Center for Sustainable Systems, and the University of Michigan claims that compared to traditional beef, plant-based burgers are more sustainable:water scarcity