The Pet Food Aisle is Going Natural

Recently, leading pet specialty retailer Petco announced plans to stop selling pet foods and treats made with artificial colours, flavours, and preservatives by mid-2019. The company developed a “no-no” list to guide manufacturers and includes all synthetic FD&C dyes in addition to Titanium Dioxide.

This is a bold move, but one that doesn’t come as too much of a surprise to those following the industry closely. At a CAGR average of just over 13%, Asia Pacific is the fastest growing region for pet food sales. Per capita spend on pet food is low in China, at just under US$9, but it is the fastest growing market globally with a CAGR of 28.6% over the last five years. Australia has the highest per capita spend in the region at US$66, and the second highest globally after the US (Source: Mintel).

The driving force behind growth in pet food and treats is premiumization as pet ‘parents’, enabled by online information sources, seek to buy what is best for their pet’s health. Consumers are trading up to premium offerings. So while the volume of pet food in traditional retail is actually down, in large part because smaller breeds are growing in popularity, category dollars continue to show solid growth.

The path to growth in pet appears to be specifically tied to health and wellness. Specifically, consumer desire to avoid ‘bad’ ingredients is driving growth more than functionality. Both grain-free and now potato-free pet food varieties are increasing share. Wet dog food is growing at more than twice the overall category rate because of a health perception – more protein. But more than any other claim, natural pet foods are appealing to today’s pet consumer. Natural colour alone is one of the main drivers of growth for dog food. In some markets, pet food brands have to compete with home-cooked food.

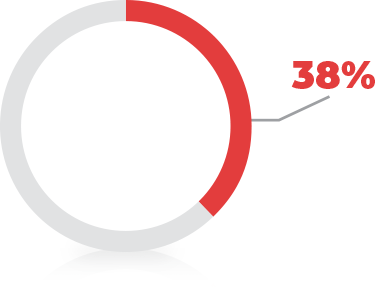

In China, for example, 38% of pet owners say they cook for their pets. Products that are made with ‘human grade’ ingredients and that have no additives and preservatives

(Source: Mintel)

While at Sensient we don’t share the view that synthetic colour is really less healthful for pets (and neither do pet food regulations), the consumer always has the final say. By de-listing pet brands that don’t switch from synthetic to natural, Petco is likely to trigger a wave of conversions to natural colours. And the company indicated a willingness to work closely with brands and natural food colour manufacturers in their announcement.

“We’re inviting pet food companies to join us on this journey, even working hand-in-hand with some to pursue potential ingredient changes to meet our new ingredient standards” said Nick Kovat, a Chief Merchandising Officer with the company.

A few years ago, our innovation team began to develop natural colour solutions that could address some of the specific challenges facing pet food and treat manufacturers. Fortunately, there are good solutions available today and more are in development. I would highly recommend checking out some of Christi Simon previous blog entries as a starting point. Some of the most relevant posts include a review of “natural Red 40” options and strategies to replace caramel.

While I might be a little biased, I firmly believe we have some of the leading natural colour technologies available for the pet industry today. Our SupraRed™ heat stable red vegetable juice, for example, is a major advancement in colour stability for pet products that go through extrusion or heat processing. This includes most pet foods as well as natural pet treats.

Meeting the evolving demands of today’s pet consumer means producing nutritious food that also looks like it meets the needs of our furry friends. If you have questions about how colour impacts pet owners’ perception of treats and food or whether you need a technical partner, please contact us. Request a consultation or send me an e-mail.